Long-Term vs. Short-Term Investing: Strategies for Different Goals

When it comes to investment portfolio management, understanding the difference between long-term and short-term investing strategies is crucial. Each approach has its own set of advantages and risks, and aligning your strategy with your financial goals is key to success.

Long-Term Investing

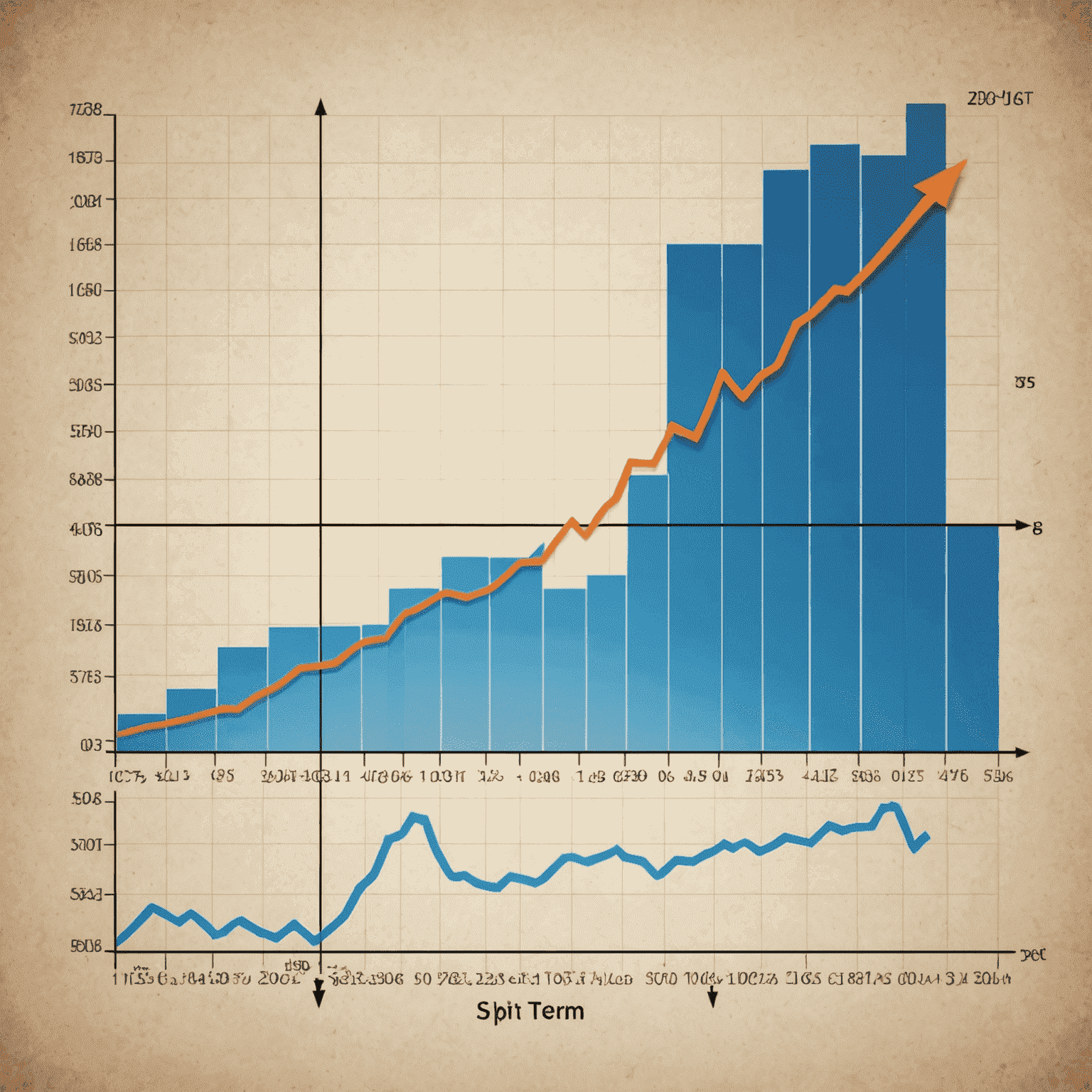

Long-term investing typically involves holding assets for several years or even decades. This strategy is often favored by those looking to build wealth over time or save for distant goals like retirement.

Key Characteristics:

- Focus on fundamental analysis and company growth potential

- Less affected by short-term market volatility

- Often involves dividend-paying stocks and compound interest

- Lower trading frequency, which can mean lower costs

Long-term investors often rely on thorough analysis to identify companies with strong fundamentals and growth potential. This approach requires patience and the ability to withstand market fluctuations without panic selling.

Short-Term Investing

Short-term investing, or trading, involves buying and selling assets within a relatively short timeframe, from minutes to months. This strategy aims to capitalize on short-term price fluctuations.

Key Characteristics:

- Focuses on technical analysis and market trends

- Requires active management and frequent monitoring

- Higher potential for quick gains, but also higher risk

- More susceptible to market volatility

Short-term traders often use technical analysis tools to identify entry and exit points. This strategy requires a deep understanding of market dynamics and the ability to make quick decisions.

Choosing the Right Strategy

The choice between long-term and short-term investing depends on several factors:

- Financial Goals: Long-term for retirement, short-term for near-future expenses

- Risk Tolerance: Short-term trading generally carries higher risk

- Time Commitment: Short-term strategies require more active management

- Market Knowledge: Short-term trading demands deeper market understanding

Many investors choose to combine both strategies, allocating a portion of their portfolio to long-term investments while using another portion for more active trading.

Conclusion

Whether you choose long-term investing, short-term trading, or a combination of both, the key is to align your strategy with your financial goals and risk tolerance. Regular portfolio analysis and adjustment are essential to ensure your investment approach continues to serve your objectives as market conditions and personal circumstances change.

Remember, successful investing requires patience, discipline, and continuous learning. Consider consulting with a financial advisor to develop a strategy that best fits your individual needs and goals.